Page Contents

Investing in the worldwide technological powerhouse, Meta Platforms, formerly known as Facebook Inc., is an enticing proposition for investors interested in diving into the dynamic intersection of social media and technology.

We will unpack various aspects of investment in this tech giant, concentrating on Meta dividends, growth possibilities, and inherent risks, providing comprehensive insights for those contemplating investing their capital in Meta Platforms.

In this article, we’ll delve deeper into Meta dividends, dissecting the opportunities and potential returns they may present for investors. So, fasten your seatbelts as we embark on a journey to decipher the enigma of Meta Platforms, a world where imagination is limitless, and the future brims with endless potential, highlighted by the prospects of Meta dividends.

We’ll take a closer look at Meta, exploring the possibilities it opens up for investors. So, buckle up as we unravel the mystery of Meta Platforms, where imagination knows no limits and the future beckons with infinite promise.

Meta Platforms And Dividends

Before any conversation on the potential dividends from an investment in Meta Platforms can be had, understanding the company’s standing on dividends is crucial.

Traditionally, tech companies often opt to reinvest their earnings into further growth and innovation, rather than paying out dividends.

Meta Platforms, previously known as Facebook, is no exception to this trend.

You May Also Like to Read: A Sneak Peek into the Metaverse[The Best Guide]

Understanding Meta Platforms And Dividends

The evolution of Facebook into Meta Platforms in late 2021 was driven by an ambition to construct a shared virtual reality space, known as the “metaverse.”

This rebranding signalled a noteworthy shift from Facebook’s primary business of social media to a much broader technological spectrum.

Discussing Meta dividends, it’s crucial to understand that Meta Platforms, mirroring many tech companies, has not traditionally offered dividends to its shareholders.

Typically, tech firms, including Meta, favour reinvesting their earnings into business expansion and innovation, effectively sidelining the issuance of Meta dividends.

This reinvestment strategy has enabled Meta to develop new products and technologies, acquire additional companies, and broaden its global digital footprint, often at the cost of Meta dividends.

However, the absence of Meta dividends does not imply the absence of returns. Investors can still realize substantial returns through capital gains, resulting from the appreciation of the stock’s price over time.

Indeed, since its IPO in 2012, Meta’s share price has experienced significant growth, providing generous rewards to long-term investors, despite the lack of traditional Meta dividends.

Potential For Future Dividends

The question of whether Meta Platforms will begin paying dividends in the future is a subject of speculation.

The company has a robust cash flow and a sizable cash balance, which could theoretically support a dividend.

However, the decision depends on Meta’s strategy and the Board’s view on how best to utilize the company’s profits.

Meta’s current focus on investment and expansion, particularly into the metaverse, suggests that the initiation of a dividend program is unlikely in the immediate future.

However, as the company matures and if its cash reserves continue to grow, the possibility could emerge, particularly if investors begin to demand a return on their investment in the form of dividends.

Dividend Alternatives: Share Buybacks

While Meta Platforms does not pay dividends, it has used another method to return capital to shareholders: share buybacks.

In a share buyback, a company buys its own shares from the marketplace, which reduces the number of outstanding shares and can increase the value of the remaining shares.

Meta has previously announced substantial buybacks, effectively returning capital to shareholders without committing to regular dividend payments.

Boost Your Knowledge on Facebook: The Essential Guide to Facebook Ad Strategy

Growth Potential of Meta Platforms

Beyond dividends, an investment in Meta Platforms also holds a considerable promise of growth.

As the company transitions from being a social media powerhouse to leading the charge into the metaverse, understanding the potential avenues for growth becomes even more important.

Meta Platforms’ Business Model

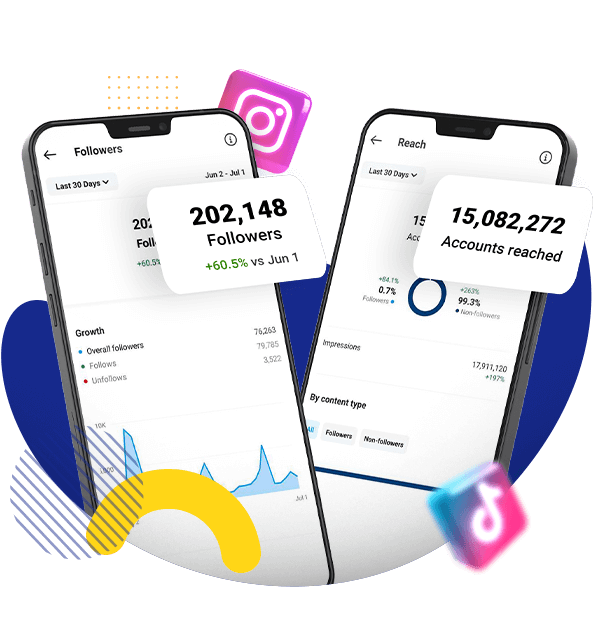

Meta Platforms’ core business remains its social media platforms: Facebook, Instagram, WhatsApp, and Messenger.

These platforms generate revenue through advertising, as businesses pay to reach their massive user base.

Meta’s shift towards the metaverse adds another growth avenue, as the company aims to create a new internet era where virtual and physical realities intersect.

This diversified business model offers multiple streams of revenue and significant growth potential.

Meta’s ad-driven model continues to be highly successful, and new ventures, like the metaverse, could represent the next frontier of digital growth.

Recent Performance And Future Outlook

Meta’s recent performance has been impressive, consistently growing its revenue and user base.

Despite facing various challenges, such as increased regulatory scrutiny and data privacy concerns, the company’s robust business model and financial performance have shown resilience.

Looking to the future, Meta’s outlook appears promising. The company’s ventures into virtual and augmented reality, artificial intelligence, and other emerging technologies present significant growth opportunities.

However, they also involve uncertainties, requiring significant R&D investment, which could impact short-term profitability.

Risks Of Investing In Meta Platforms

Every investment possesses risks, and investing in Meta Platforms, with considerations on Meta dividends, is not an exception.

From dealing with regulatory risks and the highly competitive landscape of the technology industry to navigating uncertainties surrounding the acceptance of the metaverse, investors contemplating potential Meta dividends need to weigh several factors.

Understanding these risks becomes crucial, especially when contemplating the prospects of Meta dividends, as they could influence the company’s potential to generate profits and hence, its capacity to provide dividends.

Therefore, in assessing the viability of Meta dividends, investors must pay close attention to these risk factors that could significantly shape the landscape for Meta dividends.

Regulatory And Legal Risks

Like other tech giants, Meta Platforms face regulatory and legal risks.

Governments worldwide are paying increased attention to large tech companies, driven by concerns over data privacy, market dominance, and misinformation.

Penalties, restrictions, or changes to regulations could impact Meta’s operations and profitability, posing risks for investors.

Competitive Landscape

The technology industry is highly competitive and fast-moving.

While Meta Platforms hold a dominant position today, new technologies, platforms, or changes in user behaviour can disrupt the landscape.

Keeping pace with technological advances and user preferences is critical for Meta’s long-term success and, by extension, for its shareholders.

Risks Related To The Metaverse

The metaverse is a new and unproven concept, with uncertainties about user acceptance and monetization.

While it could open new growth avenues for Meta, it also presents risks. High investment costs, technical challenges, and slower-than-expected user adoption could pose significant hurdles.

Key Regards

In conclusion, investing in Meta Platforms offers potential for substantial returns given the company’s robust business model, strong performance, and promising future outlook.

However, it also carries notable risks related to regulatory issues, competition, and uncertainties about the metaverse.

As always, investors should carefully consider these factors and their individual investment goals and risk tolerance before investing.

FAQs

Q1: Does Meta Platforms, formerly Facebook, pay dividends to its shareholders?

Meta Platforms, like many technology companies, has not traditionally paid dividends to its shareholders, preferring to reinvest its earnings back into the business for further growth and innovation.

Q2: If Meta doesn’t pay dividends, how can investors earn returns?

Investors can earn substantial returns through capital gains, which occur when the stock’s price appreciates over time. Since its IPO in 2012, Meta’s share price has seen significant growth.

Q3: What are the prospects of Meta Platforms starting a dividend program in the future?

The initiation of a dividend program in the near future seems unlikely given Meta’s current focus on investment and expansion. However, the possibility could emerge as the company matures and if its cash reserves continue to grow.

Q4: Does Meta Platforms provide any alternatives to dividends?

Yes, Meta has used share buybacks as a method to return capital to shareholders. In a share buyback, the company purchases its own shares from the market, thereby increasing the value of the remaining shares.

Q5: What are the key risks associated with investing in Meta Platforms?

Investing in Meta Platforms involves risks related to regulatory and legal challenges, the competitive landscape of the tech industry, and uncertainties surrounding user acceptance and monetization of the metaverse.

Q6: What is the growth potential of Meta Platforms?

Meta Platforms has significant growth potential owing to its diversified business model that includes social media platforms, ventures into the metaverse, and advancements in AI and other emerging technologies.